Money Topic: Credit and Debt

CREDIT, here's what you need to know:

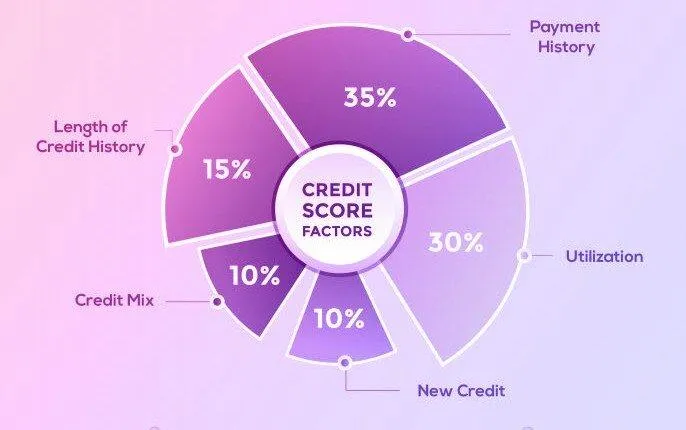

When it comes to CONSUMER CREDIT, there are five factors that determine your FICO score.

You should ALWAYS be building POSITIVE CREDIT.

Credit is a TOOL that you can LEVERAGE to create financial stability and build wealth for you and your family.

All debt is NOT bad.

If you have less than perfect credit or BAD CREDIT you have the abilty to restore your credit.

TRUE STORY, I used to feel intimidated by credit. I went YEARS without wanting to login into credit monitoring because my score was in the 400s and it was depressing. I didn't know what to do or how to fix it, so I ignored it. The thing is your credit won't fix itself and it effects too many things in your life to ignore. Above you have the breakdown of what factors into your credit score. Below you have some solutions to help you build, restore, and manage your credit and debt.

Need personalized help?

Why We Choose CREDIT over Debit

Term Life insurance protects you and your family for a specific period of time. Typically 10 year, 20 year or 30 year terms that either expire, can be renewed or converted to a universal life or whole life policy later.

Very affordable

Larger face amounts (death benefits)

Can have living benefits

Can have faster approvals

Your policy is an asset

"If you buy things you don’t need, you will soon sell things you need."

- Warren Buffet

CREDIT AND DEBT SUBTOPICS

Get The Guide:

What I Wish I Knew Before I Became A Financial Educator

What I Wish I knew Before I Became A Financial Educator reveals the money mistakes I made along my own money journey.

Inside, I'll share the impact of some of the mistakes I made and the money tips and tools I've learned to help me rebound from a low credit score and no financial security.

I'll also share how applying a few key money hacks in your money plan can have long term benefits for you and your family. So you can stop worrying about money, debt and your financial future.

If you've spoken with me before you know I am very open about my journey. It's far from perfect as I'm still learning and applying. In What I Wish I Knew Before I Became A Financial Educator you'll learn from my mistakes so you and your children (if you have children) don't have to repeat them.

Get In Touch

(404) 429-5477

Address: 1441 Woodmont Ln NW, #970, Atlanta GA 30318

Email: [email protected]

Assistance Hours :

Mon – Sat by Appointment Only